DISCLAIMER: NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL, OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED WITHIN THIS SITE, SUPPORT AND TEXTS. IF YOU DECIDE TO INVEST REAL MONEY, ALL TRADING DECISIONS ARE YOUR OWN. TRACK RECORD SHOWN IS FOR AUTHOR OWN LEARNING PURPOSES. THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. RISK OF LOSS IN TRADING FUTURES CAN BE SUBSTANTIAL.

Dec 24, 2013

Merry Christmas and Happy New Year!

I wish all of you and your loved ones peace, joy, prosperity and happiness this Christmas and the coming New Year! Cheers!

Dec 16, 2013

Announcement

I would like to announce that from today onward, I will stop updating ST01 trading results in this blog. Early year on, I threw myself a challenge to report ST01 trading signals and results "live" in the blog. Initially it was ok but after some time I found it quite difficult because in many instances I was not connected to the internet when the trade is triggered. Not long after, I changed reporting schedule to the end of the day. Yes, it works. Now I am regret to say that I will stop doing it because:-

1) It annoys a few of my business partners. They wanted to make money quietly and keep ST01 on low profile.

2) I made a deal with a private trading firm to to use my ST01 in their trading program starting next year. I am obliged to stop publicize or even mention ST01 in public.

Sorry for the inconvenience caused. Any questions about trading, you can still email to bmdtrader@gmail.com, I will try to reply as soon as possible.

Alternatively, you may also read my other blog at http://futurestradingnow.blogspot.com/.

Bye.

1) It annoys a few of my business partners. They wanted to make money quietly and keep ST01 on low profile.

2) I made a deal with a private trading firm to to use my ST01 in their trading program starting next year. I am obliged to stop publicize or even mention ST01 in public.

Sorry for the inconvenience caused. Any questions about trading, you can still email to bmdtrader@gmail.com, I will try to reply as soon as possible.

Alternatively, you may also read my other blog at http://futurestradingnow.blogspot.com/.

Bye.

Labels:

Crude Oil

,

FCPO

,

FKLI

,

Performance Summary

,

ST01

Dec 15, 2013

FCPO Performance Summary: 18 Nov - 13 Dec

FCPO failed to stay above 2600. Signs of lower prices ahead? Only God knows. In the meantime, ST01 picked up some profits this month after facing 4 consecutive losses.

Market is simple, participants make it complicated. Once you decided to use a method to tackle the market, just follow it rigorously. Then leave the market either to reward or punish your account. After that review the results and decide the next course of action. This is learning and the good news is learning never end.

Happy trading!

Market is simple, participants make it complicated. Once you decided to use a method to tackle the market, just follow it rigorously. Then leave the market either to reward or punish your account. After that review the results and decide the next course of action. This is learning and the good news is learning never end.

Happy trading!

Labels:

FCPO

,

Performance Summary

Dec 13, 2013

Position Update 20131213

Take signals as they are. Punch when you have to punch. Kick when you have to kick. Back off when you have to back off.

FKLI

S1837.5 (11/12), C1828.0 (13/12)

L1832.0 (13/12), Open position

FCPO

S2566 (13/12), C2561 (13/12)

FKLI

S1837.5 (11/12), C1828.0 (13/12)

L1832.0 (13/12), Open position

FCPO

S2566 (13/12), C2561 (13/12)

Dec 12, 2013

Position Update 20131212

Our greatest glory is not in never falling but in rising every time we fall.

FKLI

S1837.5 (11/12), Open position

FCPO

L2647 (12/12), C2630 (12/12)

FKLI

S1837.5 (11/12), Open position

FCPO

L2647 (12/12), C2630 (12/12)

Dec 11, 2013

Position Update 20131211

Knowing yourself is the beginning of all wisdom.

FKLI

S1837.5 (11/12), Open position

FCPO

Nil

FKLI

S1837.5 (11/12), Open position

FCPO

Nil

Dec 10, 2013

Position Update 20131210

领袖领导众人, 让别人甘心卖力; 老板只懂得支配众人,让别人感到渺小。

FKLI

S1833.0 (09/12), C1839.5 (10/12)

FCPO

Nil

FKLI

S1833.0 (09/12), C1839.5 (10/12)

FCPO

Nil

Dec 9, 2013

Position Update 20131209

When the trading crowd becomes alert to a change in conditions, the noise of a trading range becomes the sound of a trend.

FKLI

L1816.0 (04/12), C1833.0 (09/12)

S1833.0 (09/12), Open position

FCPO

L2680 (09/12), C2666 (09/12)

FKLI

L1816.0 (04/12), C1833.0 (09/12)

S1833.0 (09/12), Open position

FCPO

L2680 (09/12), C2666 (09/12)

Dec 7, 2013

Position Update 20131206

He humbled us all into trying to be better human beings and, more especially, to embrace reconciliation at a time when all South Africans, black and white, were still bearing the scars of apartheid.

FKLI

L1816.0 (04/12), Open position

FCPO

S2630 (05/12),C2645 (06/12)

FKLI

L1816.0 (04/12), Open position

FCPO

S2630 (05/12),C2645 (06/12)

Dec 5, 2013

Position Update 20131205

If you don't know how to live, why wonder about death?

FKLI

L1816.0 (04/12), Open position

FCPO

L2640 (04/12), C2630 (05/12)

S2630 (05/12), Open position

FKLI

L1816.0 (04/12), Open position

FCPO

L2640 (04/12), C2630 (05/12)

S2630 (05/12), Open position

Dec 4, 2013

Position Update 20131204

Popular opinion many times is not the right opinion when it comes to market direction.

FKLI

L1810.0 (02/12), C1812.5 (04/12)

L1816.0 (04/12), Open position

FCPO

S2640 (02/12), C2640 (04/12)

L2640 (04/12), Open position

FKLI

L1810.0 (02/12), C1812.5 (04/12)

L1816.0 (04/12), Open position

FCPO

S2640 (02/12), C2640 (04/12)

L2640 (04/12), Open position

Dec 3, 2013

Position Update 20131203

Traders are most bullish at market tops and most bearish at market bottoms.

FKLI

L1810.0 (02/12), Open position

FCPO

S2640 (02/12), Open position

FKLI

L1810.0 (02/12), Open position

FCPO

S2640 (02/12), Open position

Dec 2, 2013

Position Update 20131202

What doesn't kill you makes you stronger.

FKLI

L1810.0 (02/12), Open position

FCPO

L2638 (27/11), C2650 (02/12)

S2640 (02/12), Open position

FKLI

L1810.0 (02/12), Open position

FCPO

L2638 (27/11), C2650 (02/12)

S2640 (02/12), Open position

Nov 29, 2013

FKLI Performance Summary: Nov13 contract

ST01 generated a few more trading signals but only seven are triggered. Not a good month for the broker then.

Labels:

FKLI

,

Performance Summary

,

ST01

Position Update 20131129

If your trading strategy is getting you nowhere in trading, it is time to just let go and explore some new options.

FKLI

L1797.5 (25/11), C1807.5 (29/11)

FCPO

L2638 (27/11), Open position

FKLI

L1797.5 (25/11), C1807.5 (29/11)

FCPO

L2638 (27/11), Open position

Nov 28, 2013

Position Update 20131128

If you deliberately set out to be less than you are capable, you'll be unhappy for the rest of your life.

FKLI

L1797.5 (25/11), Open position

FCPO

L2638 (27/11), Open position

FKLI

L1797.5 (25/11), Open position

FCPO

L2638 (27/11), Open position

Nov 27, 2013

Position Update 20131127

Very few people can blindly follow a system, though many find it easier to be discretionary in a systematic way.

FKLI

L1797.5 (25/11), Open position

FCPO

S2615 (26/11), C2638 (27/11)

L2638 (27/11), Open position

FKLI

L1797.5 (25/11), Open position

FCPO

S2615 (26/11), C2638 (27/11)

L2638 (27/11), Open position

Nov 26, 2013

Position Update 20131126

It is extremely difficult to consistently do something simple, especially in trading.

FKLI

L1797.5 (25/11), Open position

FCPO

S2649 (25/11), C2635 (26/11)

S2615 (26/11), Open position

FKLI

L1797.5 (25/11), Open position

FCPO

S2649 (25/11), C2635 (26/11)

S2615 (26/11), Open position

Nov 25, 2013

Position Update 20131125

If you cherry-pick the signal from your trading strategies, you will invariably pick too many bad cherries.

FKLI

L1797.5 (25/11), Open position

FCPO

S2649 (25/11), Open position

FKLI

L1797.5 (25/11), Open position

FCPO

S2649 (25/11), Open position

Nov 22, 2013

Position Update 20131122

What viewers may not realize is that some pundits are bullish 100 percent of the time and other are bearish 100 per cent of the time, and still others just swing for the fences all of the time and make outrageous predictions.

FKLI

Nil

FCPO

L2574 (20/11), C2650 (22/11)

FKLI

Nil

FCPO

L2574 (20/11), C2650 (22/11)

Nov 21, 2013

Position Update 20131121

Nothing is ever as clear as black and white, and I have been doing this long enough to appreciate that anything, no matter how unlikely, can and will happen.

FKLI

Nil

FCPO

L2574 (20/11), Open position

FKLI

Nil

FCPO

L2574 (20/11), Open position

Nov 20, 2013

Position Update 20131120

Everyone wants concrete, clear rules, or indicators; chat rooms, newsletters, facebook pages, hotlines, tutors will tell them when exactly to get in and out to minimize risk and maximize profits. The truth is none works in the long run...

FKLI

L1808.0 (19/11), C1808.0 (20/11)

FCPO

S2570 (19/11), C2556 (20/11)

L2574 (20/11), Open position

FKLI

L1808.0 (19/11), C1808.0 (20/11)

FCPO

S2570 (19/11), C2556 (20/11)

L2574 (20/11), Open position

Crude Oil Performance Summary: Dec 2013 Contract (CL-Z13)

Market trends lower until 94.00. ST01 suffered some losses since early November. See how market develops...

Labels:

Crude Oil

,

Performance Summary

Nov 19, 2013

Position Update 20131119

Anyone can look at any chart and see clear entry and exit points. However, it is much more difficult to do it in real time.

FKLI

S1794.5 (18/11), C1795.0 (19/11)

L1808.0 (19/11), Open position

FCPO

S2570 (19/11), Open position

FKLI

S1794.5 (18/11), C1795.0 (19/11)

L1808.0 (19/11), Open position

FCPO

S2570 (19/11), Open position

Nov 18, 2013

Position Update 20131118

By monitoring price action, we may be able to sense the early regime change without the help of any technical indicators.

FKLI

L1786.0 (14/11), C1794.5 (18/11)

S1794.5 (18/11), Open position

FCPO

Nil

FKLI

L1786.0 (14/11), C1794.5 (18/11)

S1794.5 (18/11), Open position

FCPO

Nil

FCPO Performance Summary: 16 Oct - 15 Nov

FCPO broke out from 1 year of trading range. Many trend traders breathe a sigh of relief because market looks like will continue trending and this will definitely increase their trading profits this year. I am glad that ST01 continues to perform in this trending environment.

Labels:

FCPO

,

Performance Summary

Nov 15, 2013

Position Update 20131115

We will never know when a new trend starts or finishes until it was over.

FKLI

L1786.0 (14/11), Open position

FCPO

S2566 (13/11), C2604 (15/11)

L2604 (15/11)), C2614 (15/11)

FKLI

L1786.0 (14/11), Open position

FCPO

S2566 (13/11), C2604 (15/11)

L2604 (15/11)), C2614 (15/11)

Nov 14, 2013

Position Update 20131114

Markets have to move up to move down. Conversely, markets have to move down to move up.

FKLI

S1792.5 (12/11), C1780.5 (14/11)

L1786.0 (14/11), Open position

FCPO

S2566 (13/11), Open position

FKLI

S1792.5 (12/11), C1780.5 (14/11)

L1786.0 (14/11), Open position

FCPO

S2566 (13/11), Open position

Nov 13, 2013

Position Update 20131113

Do not try to catch all the actions in the market, even professional traders miss more than half of the great moves in the market.

FKLI

S1792.5 (12/11), Open position

FCPO

L2545 (12/11), C2585 (13/11)

S2566 (13/11), Open position

FKLI

S1792.5 (12/11), Open position

FCPO

L2545 (12/11), C2585 (13/11)

S2566 (13/11), Open position

Nov 12, 2013

Position Update 20131112

For many professional traders, long term success is rooted in simplicity in their methods.

FKLI

S1792.5 (12/11), Open position

FCPO

L2533 (11/11), C2509 (12/11)

L2545 (12/11), Open position

FKLI

S1792.5 (12/11), Open position

FCPO

L2533 (11/11), C2509 (12/11)

L2545 (12/11), Open position

Nov 11, 2013

Position Update 20131111

A good trader not only knows when to enter and exit the market, they also know when to stay out.

FKLI

L1806.5 (11/11), C1799.0 (11/11)

FCPO

S2529 (07/11), C2515 (11/11)

L2533 (11/11), Open position

FKLI

L1806.5 (11/11), C1799.0 (11/11)

FCPO

S2529 (07/11), C2515 (11/11)

L2533 (11/11), Open position

Nov 8, 2013

Position Update 20131108

Being a fighter is good, but being a fighter of dishonorable causes is downright disgraceful.

FKLI

Nil

FCPO

S2529 (07/11), Open position

FKLI

Nil

FCPO

S2529 (07/11), Open position

Nov 7, 2013

Position Update 20131107

Trading becomes the journey into self mastery.

FKLI

S1814.0 (04/11), C1801.0 (07/11)

FCPO

S2565 (06/11), C2549 (07/11)

S2529 (07/11), Open position

FKLI

S1814.0 (04/11), C1801.0 (07/11)

FCPO

S2565 (06/11), C2549 (07/11)

S2529 (07/11), Open position

Nov 6, 2013

Position Update 20131106

The trader is no longer trading to win or lose; which he cannot control with certainty. The trader is now managing the mind that produces the performance of his execution of the trade; which can be managed with a high degree of certainty.

FKLI

S1814.0 (04/11), Open position

FCPO

S2565 (06/11), Open position

FKLI

S1814.0 (04/11), Open position

FCPO

S2565 (06/11), Open position

Nov 4, 2013

Position Update 20131104

Traders are literally trading their beliefs about their capacity to manage risk and uncertainties.

FKLI

S1814.0 (04/11), Open position

FCPO

L2550 (30/10), C2589 (04/11)

FKLI

S1814.0 (04/11), Open position

FCPO

L2550 (30/10), C2589 (04/11)

Nov 1, 2013

Position Update 20131101

Many profitable traders learn to work with their emotion instead of suppressing them.

FKLI

Nil

FCPO

L2550 (30/10), Open position

FKLI

Nil

FCPO

L2550 (30/10), Open position

Oct 31, 2013

Position Update 20131031

If you think education is expensive, try ignorance.

FKLI

S1817.5 (30/10), C1806.5 (31/10)

FCPO

L2550 (30/10), Open position

FKLI

S1817.5 (30/10), C1806.5 (31/10)

FCPO

L2550 (30/10), Open position

Oct 30, 2013

Position Update 20131030

It is ok to lose some battles as long as you can win the war.

FKLI

S1817.5 (30/10), Open position

FCPO

L2486 (29/10), C2525 (30/10)

L2550 (30/10), Open position

FKLI

S1817.5 (30/10), Open position

FCPO

L2486 (29/10), C2525 (30/10)

L2550 (30/10), Open position

Oct 29, 2013

Position Update 20131029

It's not that profitable traders never lose: it's that they always bounce back from losing trades.

FKLI

Nil

FCPO

L2441 (28/10), C2457 (29/10)

L2486 (29/10), Open position

FKLI

Nil

FCPO

L2441 (28/10), C2457 (29/10)

L2486 (29/10), Open position

Oct 28, 2013

Position Update 20131028

Being reactive to actual price action instead of predictive of what price action will be more realistic.

FKLI

S1822.5 (25/10), C1818.0 (28/10)

FCPO

L2441 (28/10), Open position

FKLI

S1822.5 (25/10), C1818.0 (28/10)

FCPO

L2441 (28/10), Open position

Oct 25, 2013

Position Update 20131025

Letting price action give you trading signals is trading reality. Trading your beliefs about what price should be is wishful thinking.

FKLI

L1825.0 (24/10), C1825.0 (25/10)

S1822.5 (25/10), Open position

FCPO

Nil

FKLI

L1825.0 (24/10), C1825.0 (25/10)

S1822.5 (25/10), Open position

FCPO

Nil

Oct 24, 2013

Position Update 20131024

Avoiding the risk of ruin by risking only a small portion of your capital on each trade. It is a skill to not get arrogant and trade too big; if you risk it all enough time, you will lose it all eventually.

FKLI

L1805.0 (21/10), C1818.0 (24/10)

L1825.0 (24/10), Open position

FCPO

L2448 (22/10), C2467 (24/10)

FKLI

L1805.0 (21/10), C1818.0 (24/10)

L1825.0 (24/10), Open position

FCPO

L2448 (22/10), C2467 (24/10)

Oct 23, 2013

Position Update 20131023

Letting a winning trade run as far as it can go in your time frame is crucial to having big enough winners to pay for all your small losing trades.

FKLI

L1805.0 (21/10), Open position

FCPO

L2448 (22/10), Open position

FKLI

L1805.0 (21/10), Open position

FCPO

L2448 (22/10), Open position

Oct 22, 2013

Position Update 20131022

Great traders cut losing trades short. The ability to accept that you are wrong when a price goes to a place that you were not expecting is the skill to push the ego aside and admit you are wrong.

FKLI

L1805.0 (21/10), Open position

FCPO

S2427 (21/10), C2446 (22/10)

L2448 (22/10), Open position

FKLI

L1805.0 (21/10), Open position

FCPO

S2427 (21/10), C2446 (22/10)

L2448 (22/10), Open position

Oct 21, 2013

Position Update 20131021

Traders must have the perseverance to stick to trading until they break through to success. Many of the best traders are just the ones that had the strength to go through the pain, learn, and keep at it until they learned to be a success.

FKLI

S1803.0 (17/10), C1800.0 (21/10)

L1805.0 (21/10), Open position

FCPO

S2427 (21/10), Open position

FKLI

S1803.0 (17/10), C1800.0 (21/10)

L1805.0 (21/10), Open position

FCPO

S2427 (21/10), Open position

Oct 18, 2013

Position Update 20131018

In trading, patient and discipline pay.

FKLI

S1803.0 (17/10), Open position

FCPO

S2403 (17/10), C2400 (18/10)

FKLI

S1803.0 (17/10), Open position

FCPO

S2403 (17/10), C2400 (18/10)

Gold Futures Surged 3% in 10 Minutes.

COMEX Gold Dec13 futures surged 20++ USD in the span of 10 minutes yesterday (3:49 to 3:59 pm Malaysia Time). Anybody caught the move? Read this report from Reuters.

Labels:

Case Study

,

Gold

Crude Oil Performance Summary: Nov 2013 Contract (CL-X13)

ST01 continued to generate many trading signals even after Crude Oil stuck in range, especially in Oct. However if I used my discretionary to intervene ST01 after some sideways movements, probably I would be flat or underwater when I report CLX13 results today.

Labels:

Crude Oil

,

Performance Summary

,

ST01

Oct 17, 2013

Position Update 20131017

The price just keeps updating information and expectations of the future, which makes it the ideal way to interpret the strength of the buyers and sellers.

FKLI

L1789.5 (14/10), C1803.0 (17/10)

S1803.0 (17/10), Open position

FCPO

L2391 (16/10), C2422 (17/10)

S2403 (17/10), Open position

FKLI

L1789.5 (14/10), C1803.0 (17/10)

S1803.0 (17/10), Open position

FCPO

L2391 (16/10), C2422 (17/10)

S2403 (17/10), Open position

Oct 16, 2013

Position Update 20131016

Even if you trade in the right direction, you still could get stopped out.

FKLI

L1789.5 (14/10), Open position

FCPO

L2391 (16/10), Open position

FKLI

L1789.5 (14/10), Open position

FCPO

L2391 (16/10), Open position

Oct 15, 2013

FCPO Performance Summary: 17 Sep - 14 Oct

ST01 generated only 9 trading signals for the past month and yields 60 points profits. One friend told me FCPO is getting harder to trade and he decided to switch to foreign markets for "better" opportunities. I wish him all the best. For the time being I "hope" FCPO can stage a convincing breakout, probably above 2500 to lure more trading interest among local and foreign speculators.

Labels:

FCPO

,

Performance Summary

,

ST01

Oct 14, 2013

Position Update 20131014

Charts do not predict the future.

FKLI

S1789.5 (11/10), C1784.5 (14/10)

L1789.5 (14/10), Open position

FCPO

S2377 (11/10), C2376 (14/10)

S2364 (14/10), C2361 (14/10)

FKLI

S1789.5 (11/10), C1784.5 (14/10)

L1789.5 (14/10), Open position

FCPO

S2377 (11/10), C2376 (14/10)

S2364 (14/10), C2361 (14/10)

Oct 11, 2013

Position Update 20131011

Dream is not that you see in the sleep; dream is that does not allow you to sleep.

FKLI

L1779 (10/10), C1796.5 (11/10)

S1789.5 (11/10), Open position

FCPO

L2381 (10/10), C2395 (11/10)

S2377 (11/10), Open position

FKLI

L1779 (10/10), C1796.5 (11/10)

S1789.5 (11/10), Open position

FCPO

L2381 (10/10), C2395 (11/10)

S2377 (11/10), Open position

Oct 10, 2013

Position Update 20131010

When one door of opportunity closes, another opens, but often we look so long at the closed door that we do not see the one that has been opened for us.

FKLI

L1779.0 (10/10), Open position

FCPO

L2342 (08/10), C2370 (10/10)

L2381 (10/10), Open position

FKLI

L1779.0 (10/10), Open position

FCPO

L2342 (08/10), C2370 (10/10)

L2381 (10/10), Open position

Oct 9, 2013

Position Update 20131009

Happy traders plan their trades but not their results.

FKLI

L1780.0 (08/10), C1773.5 (09/10)

FCPO

L2342 (08/10), Open position

FKLI

L1780.0 (08/10), C1773.5 (09/10)

FCPO

L2342 (08/10), Open position

Oct 8, 2013

Position Update 20131008

Each day in the market, I make a journey through a twisting bumpy rising falling road, and arrive safe and sound. This is life of a trader.

FKLI

L1780.0 (08/10), Open position

FCPO

L2342 (08/10), Open position

FKLI

L1780.0 (08/10), Open position

FCPO

L2342 (08/10), Open position

Oct 7, 2013

Position Update 20131007

Even the best fishermen will come home empty handed if they dip their lines into unstocked ponds.

FKLI

L1776.0 (03/10), C1782.0 (07/10)

FCPO

S2306 (04/10), C2320 (07/10)

FKLI

L1776.0 (03/10), C1782.0 (07/10)

FCPO

S2306 (04/10), C2320 (07/10)

Oct 4, 2013

Position Update 20131004

The market doesn't make you right, you make yourself right.

FKLI

L1776.0 (03/10), Open position

FCPO

S2306 (04/10), Open psoition

FKLI

L1776.0 (03/10), Open position

FCPO

S2306 (04/10), Open psoition

Oct 3, 2013

Position Update 20131003

Trend is more likely to continue than reverse because people don't change their beliefs easily.

FKLI

L1776.0 (03/10), Open position

FCPO

L2319 (01/10), C2293 (03/10)

FKLI

L1776.0 (03/10), Open position

FCPO

L2319 (01/10), C2293 (03/10)

Oct 2, 2013

Position Update 20131002

The more accepting you are of your mistakes, the easier it will be to make the next attempt.

FKLI

Nil

FCPO

L2319 (01/10), Open position

FKLI

Nil

FCPO

L2319 (01/10), Open position

Oct 1, 2013

Position Update 20131001

You gotta accept losses when market proved you were wrong because market is always right.

FKLI

Nil

FCPO

L2319 (01/10), Open position

FKLI

Nil

FCPO

L2319 (01/10), Open position

Sep 30, 2013

Position Update 20130930

When you are feeling pain, instead of being focused on what the market is communicating to you, you will be focussing on the information that will ease your pain.

FKLI

S1766.0 (30/09), C1773.0 (30/09)

FCPO

Nil

FKLI

S1766.0 (30/09), C1773.0 (30/09)

FCPO

Nil

Sep 27, 2013

Position Update 20130927

If you can't define the market conditions or the decision making process that how you will trade, obviously you have no idea what you are doing.

FKLI

S1785.5 (25/09), C1771.5 (27/09)

FCPO

S2301 (24/09), C2268 (27/09)

FKLI

S1785.5 (25/09), C1771.5 (27/09)

FCPO

S2301 (24/09), C2268 (27/09)

Sep 26, 2013

Position Update 20130926

Stop scanning for news, opinions, or any other form of statements that support your position.

FKLI

S1785.5 (25/09), Open position

FCPO

S2301 (24/09), Open position

FKLI

S1785.5 (25/09), Open position

FCPO

S2301 (24/09), Open position

Sep 25, 2013

Position Update 20130925

If your trading strategy is not in line with your mental framework, it is almost impossible to employ your mental discipline to make flawless execution a habit.

FKLI

L1791.0 (23/09), C1787.5 (25/09)

S1785.5 (25/09), Open position

FCPO

S2301 (24/09), Open position

FKLI

L1791.0 (23/09), C1787.5 (25/09)

S1785.5 (25/09), Open position

FCPO

S2301 (24/09), Open position

Sep 24, 2013

Position Update 20130924

As a trader, it is more important to know that you will always follow your rules than to make money, because no matter how much money you make, you will definitely give back to the market if you can't follow your rules.

FKLI

L1797.5 (20/09), Open position <==Wrong

L1791.0 (23/09), Open position <==Correction

FCPO

L2298 (23/09), C2324 (24/09)

S2301 (24/09), Open position

FKLI

L1797.5 (20/09), Open position <==Wrong

L1791.0 (23/09), Open position <==Correction

FCPO

L2298 (23/09), C2324 (24/09)

S2301 (24/09), Open position

Sep 23, 2013

Position Update 20130923

The wrong bull has stopped.

FKLI

L1797.5 (20/09), C1785.0 (23/09)

L1791.0 (23/09), Open position

FCPO

S2313 (19/09), C2285 (23/09)

L2298 (23/09), Open position

FKLI

L1797.5 (20/09), C1785.0 (23/09)

L1791.0 (23/09), Open position

FCPO

S2313 (19/09), C2285 (23/09)

L2298 (23/09), Open position

Sep 21, 2013

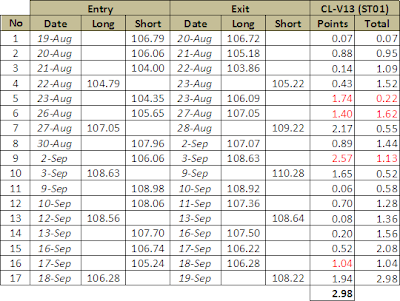

Crude Oil Performance Summary: Oct 2013 Contract (CL-V13)

外国的月亮比较圆, 还是外国的石油比较甜?

Crude Oil Contract (CL) trading in CME also know as Light Sweet Crude Oil (WTI). The word "sweet" refers to low sulphur content.

ST01 rides a roller coaster month for CLV13 contract. At the end, it achieved another profit month. If you ask me what is the dominant trend for the crude oil market, basically I have no idea. (Some experienced traders once said you don't need to know where the market is heading in order to make money. All you have to do is just follow.)

Labels:

Crude Oil

,

Performance Summary

,

Quote

,

ST01

Sep 20, 2013

Position Update 20130920

Getting rich quick only lead to a great deal of anxiety and frustration if you don't have the skills to keep it.

FKLI

L1797.5 (20/09), Open position

FCPO

S2313 (19/09), Open position

FKLI

L1797.5 (20/09), Open position

FCPO

S2313 (19/09), Open position

Sep 19, 2013

Position Update 20130919

但愿TREND长久, 大家赚大钱。

FKLI

S1786.5 (19/09), C1790.0 (19/09)

FCPO

L2350 (17/09), C2320 (19/09)

S2313 (19/09), Open position

FKLI

S1786.5 (19/09), C1790.0 (19/09)

FCPO

L2350 (17/09), C2320 (19/09)

S2313 (19/09), Open position

Sep 18, 2013

Position Update 20130918

The greater the expectation traders have about something happening, the less tolerance they have for disappointment.

FKLI

S1773.0 (17/09), C1770.0 (18/09)

FCPO

L2350 (17/09), Open position

FKLI

S1773.0 (17/09), C1770.0 (18/09)

FCPO

L2350 (17/09), Open position

Sep 17, 2013

Position Update 20130917

Retail traders do not have the resources to move prices in the direction they desired, therefore the best thing they can do is learn to identify and align themselves with the side that has established dominance in the market until the dominance disappears.

FKLI

S1773.0 (17/09), Open position

FCPO

L2350 (17/09), Open position

FKLI

S1773.0 (17/09), Open position

FCPO

L2350 (17/09), Open position

Sep 16, 2013

Short Term Trading (STT) vs Long Term Trend Following (LTTF)

In this post I want to answer

a good question from Zac Lim, regarding short term trading and long term trend

following. I will share with you my experience in developing and trading these

two completely different strategies. Before I discuss about the difference

between short term trading (STT) and long term trend following (LTTF), let me define each trading strategy in short. In my definition, I refer short term trading

(STT) as trading decision made based on intraday data such as minutes chart, whereas long term trend trading (LTTF) uses end of day (EOD) or weekly data to

generate trading signal. Below are the summaries…

Win Rate

I emphasize a high win rate

when designing STT because short term market movements are more “random” as

compare to LTTF. STT need to capture profit in a relatively “random” market

movement. Once profit is there, I will lock it before it disappears. Therefore,

most trades end in profits. LTTF is different.

It wins 3-4 out of 10 trades made, however winner’s magnitude is far

greater than loser one, making it still profitable to trade.

Trading Philosophy

As the name suggests, LTTF’s

idea is quite simple that is following trend. It follows market only after

prices start to show trending characteristic. STT on the other hand employs both

trend following and counter trend ideas in its practice. Sometimes it tries to "predict" when the trend will end, thus initiate position in the opposite trend

direction.

Money Management

I use completely different

kind of money management systems to trade STT and LTTF due to their significant

parity in Win Rate just described above. Besides that, profit per trade from

LTTF is significant higher than of STT.

Cost

STT generates around 150

trading signals a year compare to LTTF 20-30 trades (including contract roll

over). STT trade more frequently compare to LTTF, thereby paying a lot more in

commissions and slippages.

Mindset

I have to establish different

mindsets for each trading strategy. When I trade STT, my energy level is higher

and I am more reflexive. I need to change my market perspective fast because

system may generate completely opposite signals in the short period of time. In

some instance, I will need to stay in front of screen to “wait” for system to

issue trend change signal. In LTTF, I am more relaxed, and often forgot that I

still hold long term position in LTTF. Since I use EOD data for LTTF, I spend

less than 5 minutes a day to complete my “job” trading LTTF.

Data

I use end of day (EOD) data

when designing LTTF. While STT uses both EOD and minutes data to generate

trading signals. One can obtain EOD free of charge from exchange website or

from brokers. Minutes, intraday, or tick data can be quite expensive and hard

to find, unless you are diligently enough to collect it every day.

Drawdown

Drawdown in STT tends to be

shallow and short as compare to LTTF. To trade LTTF, one needs to have the

patience. I once experienced drawdown period of more than 1 year before account

broke new equity high. Besides that, the quantum of drawdown in LTTF is huge. A

50% drawdown is considered normal in many LTTF programs.

Diversification

STT need active management somewhere

close to intraday level. It is very stressful and difficult to diversify among

many markets. When certain markets open nearly 24 hours a day, I would say it

is impossible to do it alone. Trading LTTF can be done in 5 minutes a day, usually

after market hours, making it a good candidate for one to diversify among many

futures markets.

Conclusion

STT and LTTF clashed occasionally,

meaning I hold both long and short positions in the same market. It happens probably

when a particular market is doing sideways movements. Personally, I prefer LTTF

over STT due to my slow and steady personality. I still trade both in order to

capture different market niches in both long and short term timeframe.

Sep 13, 2013

FCPO Performance Summary: 16 Aug - 13 Sep

FCPO attempted 2500 but failed. Price moved back into boring range of 2150-2500. Sigh... Consider ST01 still lucky to achieve profit of 100++ points this month.

Labels:

FCPO

,

Performance Summary

,

ST01

Position Update 20130913

The best place to find a helping hand is at the end of your own arm.

FKLI

S1769.0 (12/09), C1768.0 (13/09)

FCPO

S2344 (13/09), C2345 (13/09)

FKLI

S1769.0 (12/09), C1768.0 (13/09)

FCPO

S2344 (13/09), C2345 (13/09)

Sep 12, 2013

Position Update 20130912

Adapt is to identify and actively change something that is already inside of us so there is a higher degree of correspondence between the inside and outside.

FKLI

S1769.0 (12/09), Open position

FCPO

S2353 (10/09), C2337 (12/09)

FKLI

S1769.0 (12/09), Open position

FCPO

S2353 (10/09), C2337 (12/09)

Sep 11, 2013

Position Update 20130911

To learn a skill, we usually have to break the skill down into a series of small steps and concentrate on each individual step until we can put all steps together into a series of effective movements.

FKLI

Nil

FCPO

S2353 (10/09), Open position

FKLI

Nil

FCPO

S2353 (10/09), Open position

Sep 10, 2013

Position Update 20130910

Profitable traders need only a slight advantage over the market to make a living.

FKLI

L1724.0 (09/09), C1762.0 (10/09)

FCPO

S2423 (09/09), C2380 (10/09)

S2353 (10/09), Open position

FKLI

L1724.0 (09/09), C1762.0 (10/09)

FCPO

S2423 (09/09), C2380 (10/09)

S2353 (10/09), Open position

Sep 9, 2013

Position Update 20130909

We can put our best efforts and intentions out there but we can't control the outcome.

FKLI

L1708.0 (06/09), C1716.0 (09/09)

L1724.0 (09/09), Open position

FCPO

L2415 (04/09), C2434 (09/09)

S2423 (09/09), Open position

FKLI

L1708.0 (06/09), C1716.0 (09/09)

L1724.0 (09/09), Open position

FCPO

L2415 (04/09), C2434 (09/09)

S2423 (09/09), Open position

Sep 6, 2013

Position Update 20130906

A thought is like a photo flash. It lightens the situation for a short moment, but it is not enough to illuminate the environment permanently.

FKLI

L1708.0 (06/09), Open position

FCPO

L2415 (04/09), Open position

FKLI

L1708.0 (06/09), Open position

FCPO

L2415 (04/09), Open position

Sep 5, 2013

Position Update 20130905

Why trading is so difficult? Because nothing in life is more difficult than to change your personality.

FKLI

S1703.0 (03/09), C1708.0 (05/09)

FCPO

L2415 (04/09), Open position

FKLI

S1703.0 (03/09), C1708.0 (05/09)

FCPO

L2415 (04/09), Open position

Sep 4, 2013

Position Update 20130904

No one like to buy more and more apples that rot away just because they are getting cheaper. But in the investment world, people like to buy into downtrend.

FKLI

S1703.0 (03/09), Open position

FCPO

S2415 (03/09), C2402 (04/09)

L2415 (04/09), Open position

FKLI

S1703.0 (03/09), Open position

FCPO

S2415 (03/09), C2402 (04/09)

L2415 (04/09), Open position

Sep 3, 2013

Position Update 20130903

We are not able to do something that is not part of our thought.

FKLI

S1700.0 (02/09), C1715.5 (03/09)

S1703.0 (03/09), Open position

FCPO

S2415 (03/09), Open position

FKLI

S1700.0 (02/09), C1715.5 (03/09)

S1703.0 (03/09), Open position

FCPO

S2415 (03/09), Open position

Sep 2, 2013

Position Update 20130902

Don't take anything for granted. Nothing is constant except change.

FKLI

S1700.0 (02/09), Open position

FCPO

Nil

FKLI

S1700.0 (02/09), Open position

FCPO

Nil

Aug 30, 2013

FKLI Performance Summary: Aug13 contract

FKLI experienced a volatile August with high 1806.0 and low 1653.0. Too bad ST01 only captured a small profits relative to such a big range move. Below are the trade summary.

Labels:

FKLI

,

Performance Summary

,

ST01

Position Update 20130830

Let go of you expectations and pre-judgements of the markets, you might find it interesting as you explore it without any self limitations.

FKLI

Nil

FCPO

S2438 (29/08), C2414 (30/08)

FKLI

Nil

FCPO

S2438 (29/08), C2414 (30/08)

Aug 29, 2013

Position Update 20130829

Only heroes want to buy at the exact bottom and sell at the exact top.

FKLI

S1701.5 (27/08), C1689.0 (29/08)

FCPO

L2434 (26/08), C2425 (29/08)

S2438 (29/08), Open position

FKLI

S1701.5 (27/08), C1689.0 (29/08)

FCPO

L2434 (26/08), C2425 (29/08)

S2438 (29/08), Open position

Aug 28, 2013

Position Update 20130828

If you fail to detect destructive patterns early, then they become destructive habits that will be much more difficult to break later.

FKLI

S1701.5 (27/08), Open position

FCPO

L2434 (26/08), Open position

FKLI

S1701.5 (27/08), Open position

FCPO

L2434 (26/08), Open position

Aug 27, 2013

Position Update 20130827

Too much analysis leads to hesitation, but not enough analysis leads to impulsiveness.

FKLI

S1701.5 (27/08), Open position

FCPO

L2434 (26/08), Open position

FKLI

S1701.5 (27/08), Open position

FCPO

L2434 (26/08), Open position

Aug 26, 2013

Position Update 20130826

Trend, once established, has greater odds of continuing than of reversing.

FKLI

S1716.0 (22/08), C1717.0 (26/08)

FCPO

L2434 (26/08), Open position

FKLI

S1716.0 (22/08), C1717.0 (26/08)

FCPO

L2434 (26/08), Open position

Aug 23, 2013

Position Update 20130823

In trading, you pay for the price for confirmation, by entering a bit later than the aggressive traders.

FKLI

S1716.0 (22/08), Open position

FCPO

L2345 (22/08), C2350 (23/08)

FKLI

S1716.0 (22/08), Open position

FCPO

L2345 (22/08), C2350 (23/08)

Aug 22, 2013

Position Update 20130822

Traders are far less likely to panic when initiating a new position than they are exiting an open position.

FKLI

S1716.0 (22/08), Open position

FCPO

L2345 (22/08), Open position

FKLI

S1716.0 (22/08), Open position

FCPO

L2345 (22/08), Open position

Aug 21, 2013

Position Update 20130821

Market participants are mostly irrational in making trading decisions, this leads to irrational market behaviour, and fortunately irrational behaviour creates inefficiency in the market, which we can exploit to our advantage.

FKLI

S1753.5 (20/08), C1742.5 (21/08)

FCPO

S2323 (20/08), C2318 (21/08)

FKLI

S1753.5 (20/08), C1742.5 (21/08)

FCPO

S2323 (20/08), C2318 (21/08)

Aug 20, 2013

Position Update 20130820

In the trading environment, the outcome of your decision is immediate, and you are powerless to change anything except your mind.

FKLI

S1780.5 (19/08), C1766.0 (20/08)

S1753.5 (20/08), Open position

FCPO

L2332 (16/08), C2338 (20/08)

S2323 (20/08), Open position

FKLI

S1780.5 (19/08), C1766.0 (20/08)

S1753.5 (20/08), Open position

FCPO

L2332 (16/08), C2338 (20/08)

S2323 (20/08), Open position

Aug 19, 2013

Crude Oil Performance Summary: Sep 2013 Contract (CL-U13)

Sep'13 Crude Oil futures was trapped in "narrow ranges" of 102.00 and 109.00. ST01 caught some moves and pocketed some profits. :-)

Labels:

Crude Oil

,

Performance Summary

,

ST01

Position Update 20130819

If you don't acknowledge your true starting point, you cannot take the next most appropriate step in the development of any skill you intend to learn.

FKLI

L1792.0 (16/08), C1785.0 (19/08)

S1780.5 (19/08), Open position

FCPO

L2332 (16/08), Open position

FKLI

L1792.0 (16/08), C1785.0 (19/08)

S1780.5 (19/08), Open position

FCPO

L2332 (16/08), Open position

Aug 16, 2013

Position Update 20130816

Most people do not hold neutral view of the market, they are constantly looking for what they expect to see.

FKLI

L1792.0 (16/08), Open position

FCPO

L2332 (16/08), Open position

FKLI

L1792.0 (16/08), Open position

FCPO

L2332 (16/08), Open position

Aug 15, 2013

FCPO Performance Summary: 16 Jul - 15 Aug

FCPO staged a reversal in end July and provides many trading opportunities for short term traders. ST01 managed to capture some moves and secured another profit this month.

Labels:

FCPO

,

Performance Summary

,

ST01

Position Update 20130815

Can we still make money in the market? I think as long as people still conservative with profits and risky with losses, we can.

FKLI

Nil

FCPO

S2291 (14/08), C2304 (15/08)

FKLI

Nil

FCPO

S2291 (14/08), C2304 (15/08)

Aug 14, 2013

Position Update 20130814

I was forced by the markets to acknowledge many things about myself that I otherwise wouldn't consider in the first place.

FKLI

L1786.5 (12/08), C1800.0 (14/08)

FCPO

L2303 (13/08), C2305 (14/08)

S2291 (14/08), Open position

FKLI

L1786.5 (12/08), C1800.0 (14/08)

FCPO

L2303 (13/08), C2305 (14/08)

S2291 (14/08), Open position

Aug 13, 2013

Position Update 20130813

Someone else's errors in judgement are opportunities, and good traders understand how these errors manifest themselves in market price action.

FKLI

L1786.5 (12/08), Open position

FCPO

L2225 (12/08), C2275 (13/08)

L2303 (13/08), Open position

FKLI

L1786.5 (12/08), Open position

FCPO

L2225 (12/08), C2275 (13/08)

L2303 (13/08), Open position

Aug 12, 2013

Position Update 20130812

If you don't have the financial power to move prices in your desired direction, then you are going to learn how to flow with and constantly adapt to the market conditions.

FKLI

L1786.5 (12/08), Open position

FCPO

S2236 (05/08), C2222 (12/08)

L2225 (12/08), Open position

FKLI

L1786.5 (12/08), Open position

FCPO

S2236 (05/08), C2222 (12/08)

L2225 (12/08), Open position

Aug 7, 2013

Position Update 20130807

Many successful traders said they didn't achieve any measure of consistency in accumulating wealth from trading until they learn self-discipline, emotional control and the ability to change their minds to flow with the markets.

FKLI

L1783.0 (05/08), C1778.0 (07/08)

FCPO

S2236 (05/08), Open position

FKLI

L1783.0 (05/08), C1778.0 (07/08)

FCPO

S2236 (05/08), Open position

Aug 6, 2013

Position Update 20130806

Confidence and fear are states of mind that are similar in nature, only separated by degree.

FKLI

L1783.0 (05/08), Open position

FCPO

S2236 (05/08), Open position

FKLI

L1783.0 (05/08), Open position

FCPO

S2236 (05/08), Open position

Aug 5, 2013

Position Update 20130805

The less I care about whether next trade would be a loser, the clearer things become, making it easier for me to move in and out of positions, cutting losses short and make myself available to take the next opportunity.

FKLI

L1783.0 (05/08), Open position

FCPO

L2281 (02/08), C2249 (05/08)

S2236 (05/08), Open position

FKLI

L1783.0 (05/08), Open position

FCPO

L2281 (02/08), C2249 (05/08)

S2236 (05/08), Open position

Aug 2, 2013

Position Update 20130802

You will come across some really big losses, no matter how good your system is or how well prepared you are.

FKLI

L1773.5 (01/08), C1780.5 (02/08)

FCPO

L2251 (01/08), C2260 (02/08)

L2281 (02/08), Open position

FKLI

L1773.5 (01/08), C1780.5 (02/08)

FCPO

L2251 (01/08), C2260 (02/08)

L2281 (02/08), Open position

Aug 1, 2013

Position Update 20130801

Listen to the markets and do not impose your will upon them.

FKLI

L1773.5 (01/08), Open position

FCPO

L2251 (01/08), Open position

FKLI

L1773.5 (01/08), Open position

FCPO

L2251 (01/08), Open position

Jul 31, 2013

FKLI Performance Summary: Jul13 contract

FKLI attempted to stay above 1800 but failed. However a sharp drop of more than 20 points today is enough for system to post another profit month for FKLI Jul13 contract. Here are the numbers...

Labels:

FKLI

,

Performance Summary

Position Update 20130731

Price is faster than any derivatives.

FKLI

S1803.0 (29/07), C1774.5 (31/07)

FCPO

L2159 (30/07), C2232 (31/07)

FKLI

S1803.0 (29/07), C1774.5 (31/07)

FCPO

L2159 (30/07), C2232 (31/07)

Jul 30, 2013

Position Update 20130730

Tons of trading opportunities come your way each day, but if you are not prepared to capitalize on them, they mean nothing to you.

FKLI

S1803.0 (29/07), Open position

FCPO

L2159 (30/07), Open position

FKLI

S1803.0 (29/07), Open position

FCPO

L2159 (30/07), Open position

Jul 29, 2013

Position Update 20130729

Risk no more than you can afford to lose, and also risk enough so that a win is meaningful. If there is no such amount, don't trade.

FKLI

S1803.0 (29/07), Open position

FCPO

Nil

FKLI

S1803.0 (29/07), Open position

FCPO

Nil

Jul 26, 2013

Position Update 20130726

A hard fall means a hard bounce...only if you are made up of the right material.

FKLI

S1810.5 (25/07), C1814.0 (26/07)

FCPO

S2194 (25/07), C2163 (26/07)

FKLI

S1810.5 (25/07), C1814.0 (26/07)

FCPO

S2194 (25/07), C2163 (26/07)

Jul 25, 2013

Position Update 20130725

If there is money on the table, it belongs to the person who picks it up.

FKLI

L1800.5 (19/07), C1810.5 (25/07)

S1810.5 (25/07), Open position

FCPO

S2234 (24/07), C2212 (25/07)

S2194 (25/07), Open position

FKLI

L1800.5 (19/07), C1810.5 (25/07)

S1810.5 (25/07), Open position

FCPO

S2234 (24/07), C2212 (25/07)

S2194 (25/07), Open position

Jul 24, 2013

Position Update 20130724

My goal in the game of speculation is not to be the first one to jump in when the trend started, but to make money and keep my risk under control.

FKLI

L1800.5 (19/07), Open position

FCPO

S2234, Open position

FKLI

L1800.5 (19/07), Open position

FCPO

S2234, Open position

Jul 23, 2013

Position Update 20130723

There is always plenty of bullish and bearish news floating around the markets each day.

FKLI

L1800.5 (19/07), Open position

FCPO

Nil

Jul 22, 2013

Position Update 20130722

If you don't have sufficient funds, then you cannot practice adequate position sizing.

FKLI

L1800.5 (19/07), Open position

FCPO

S2265 (19/07), C2260 (22/07)

FKLI

L1800.5 (19/07), Open position

FCPO

S2265 (19/07), C2260 (22/07)

Jul 19, 2013

Position Update 20130719

How much drawdown are you willing to tolerate in order to achieve your desired rate of return?

FKLI

L1793.5 (18/07), C1797.0 (19/07)

L1800.5 (19/07), Open position

FCPO

L2259 (17/07), C2289 (19/07)

S2265 (19/07), Open position

FKLI

L1793.5 (18/07), C1797.0 (19/07)

L1800.5 (19/07), Open position

FCPO

L2259 (17/07), C2289 (19/07)

S2265 (19/07), Open position

Crude Oil Performance Summary: Aug 2013 Contract (CL-Q13)

Crude Oil futures (CLQ13) staged a convincing breakout above USD100 per barrel earlier July. System managed to take advantage of the bullish sentiment and achieved another profit month for CLQ13 contract.

Labels:

Crude Oil

,

Performance Summary

Jul 18, 2013

Position Update 20130718

You cannot design a trading system until you know something about yourself.

FKLI

L1793.5 (18/07), Open position

FCPO

L2259 (17/07), Open position

FKLI

L1793.5 (18/07), Open position

FCPO

L2259 (17/07), Open position

Jul 17, 2013

Position Update 20130717

When market is trending strongly, pullback tends to be shallow or no pullback at all.

FKLI

L1790.0 (16/07), C1785.0 (17/07)

FCPO

S2226 (16/07), C2259 (17/07)

L2259 (17/07), Open position

FKLI

L1790.0 (16/07), C1785.0 (17/07)

FCPO

S2226 (16/07), C2259 (17/07)

L2259 (17/07), Open position

Jul 16, 2013

Position Update 20130716

Nothing is truer than the price itself.

FKLI

S1787.0 (15/07), C1790.0 (16/07)

L1790.0 (16/07), Open position

FCPO

S2226 (16/07), Open position

FKLI

S1787.0 (15/07), C1790.0 (16/07)

L1790.0 (16/07), Open position

FCPO

S2226 (16/07), Open position

Jul 15, 2013

FCPO Performance Summary: 17 June - 15 Jul

Finally, system managed to return to profit this month. Thanks to the explosive move for the past 2 trading sessions. Out of 13 trades, system won 7 and lost 6.

Labels:

FCPO

,

Performance Summary

Position Update 20130715

No two successful traders trade identically.

FKLI

S1787.0 (15/07), Open position

FCPO

S2386 (10/07), C2273 (15/07)

FKLI

S1787.0 (15/07), Open position

FCPO

S2386 (10/07), C2273 (15/07)

Jul 13, 2013

Jul 12, 2013

Position Update 20130712

If you want to know everything about the market, go to the beach. Push and pull your hands with the waves. Some are bigger waves, some are smaller. But, if you try to push the wave out when it's coming in, it will never happen. The market is always right.

FKLI

Nil

FCPO

S2386 (10/07), Open position

FKLI

Nil

FCPO

S2386 (10/07), Open position

Jul 11, 2013

Position Update 20130711

Liquidity disappears the moment you need it most.

FKLI

S1771.0 (10/07), C1784.0 (11/07)

I ignored the long signal due to FKLI knee jerk reaction this morning.

FCPO

S2386 (10/07), Open position

FKLI

S1771.0 (10/07), C1784.0 (11/07)

I ignored the long signal due to FKLI knee jerk reaction this morning.

FCPO

S2386 (10/07), Open position

Jul 10, 2013

Position Update 20130710

You have to believe and have confidence in the system you trade. Focus on executing the signal flawlessly. The results will take care of themselves.

FKLI

S1771.0 (10/07), Open position

FCPO

L2399 (09/07), C2386 (10/07)

S2386 (10/07), Open position

FKLI

S1771.0 (10/07), Open position

FCPO

L2399 (09/07), C2386 (10/07)

S2386 (10/07), Open position

Jul 9, 2013

Position Update 20130709

Momentum is less reliable when volatility is at extreme level.

FKLI

S1778.0 (05/07), C1769.0 (09/07)

FCPO

S2368 (08/07), C2391 (09/07)

L2399 (09/07), Open position

FKLI

S1778.0 (05/07), C1769.0 (09/07)

FCPO

S2368 (08/07), C2391 (09/07)

L2399 (09/07), Open position

Jul 8, 2013

Position Update 20130708

Avoid those things that give you comfort. It is usually false comfort.

FKLI

S1778.0 (05/07), Open position

FCPO

S2368 (08/07), Open position

FKLI

S1778.0 (05/07), Open position

FCPO

S2368 (08/07), Open position

Jul 5, 2013

Position Update 20130705

On the other side of every trade is somebody who is equally convinced that it is going in the opposite direction.

FKLI

L1777.5 (04/07), C1781.5 (05/07)

S1778.0 (05/07), Open position

FCPO

L2365 (05/07), C2354 (05/07)

Jul 4, 2013

Position Update 20130704

You need to have life outside trading. Get a hobby just to keep you sane.

FKLI

L1777.5 (04/07), Open position

FCPO

L2366 (03/07), C2372 (04/07)

FKLI

L1777.5 (04/07), Open position

FCPO

L2366 (03/07), C2372 (04/07)

Jul 3, 2013

Position Update 20130703

狗熊所见略同。

FKLI

Nil

FCPO

S2339 (02/07), C2356 (03/07)

L2366 (03/07), Open position

FKLI

Nil

FCPO

S2339 (02/07), C2356 (03/07)

L2366 (03/07), Open position

Jul 2, 2013

Position Update 20130702

The higher stocks prices rise, the shorter their dresses get.

FKLI

L1773.5 (01/07), C1778.0 (02/07)

FCPO

S2339 (02/07), Open position

FKLI

L1773.5 (01/07), C1778.0 (02/07)

FCPO

S2339 (02/07), Open position

Jul 1, 2013

Position Update 20130701

We usually learn the most from our biggest struggles and our biggest mistakes.

FKLI

L1773.5 (01/07), Open position

FCPO

L2372 (01/07), C2353 (01/07)

FKLI

L1773.5 (01/07), Open position

FCPO

L2372 (01/07), C2353 (01/07)

Jun 28, 2013

FKLI Performance Summary: Jun13 contract

As usual, it is time to report my FKLI performance summary for June 2013. System registered 8 wins from 12 trades. 5 trades posted double digit points profit, made this month the best month for 2013 so far.

Labels:

FKLI

,

Performance Summary

Position Update 20130628

Risk can be pre-determined but reward is unpredictable.

FKLI

L1758.5 (28/06), C1768.0 (28/06)

FCPO

L2371 (28/06), C2356 (28/06)

FKLI

L1758.5 (28/06), C1768.0 (28/06)

FCPO

L2371 (28/06), C2356 (28/06)

Jun 27, 2013

Position Update 20130627

Painful processes pave way for a smoother path in the future.

FKLI

Nil

FCPO

S2387 (26/06), C2372 (27/06)

S2360 (27/06), Open position

FKLI

Nil

FCPO

S2387 (26/06), C2372 (27/06)

S2360 (27/06), Open position

Jun 26, 2013

Position Update 20130626

Good trading is usually boring.

FKLI

S1722.5 (26/06), C1733.0 (26/06)

FCPO

S2387 (26/06), Open position

FKLI

S1722.5 (26/06), C1733.0 (26/06)

FCPO

S2387 (26/06), Open position

Jun 25, 2013

Position Update 20130625

A robust strategy performance numbers is not as attractive as one that has been fitted to the data.

FKLI

S1737.0 (24/06), C1734.5 (25/06)

FCPO

S2422 (21/06), C2408 (25/06)

FKLI

S1737.0 (24/06), C1734.5 (25/06)

FCPO

S2422 (21/06), C2408 (25/06)

Jun 24, 2013

Position Update 20130624

Carefully weighing the facts before you come to a decision.

FKLI

L1738.5 (21/06), C1755.0 (24/06)

S1737.0 (24/06), Open position

FCPO

S2422 (21/06), Open position

FKLI

L1738.5 (21/06), C1755.0 (24/06)

S1737.0 (24/06), Open position

FCPO

S2422 (21/06), Open position

Jun 21, 2013

Position Update 20130621

If you pre-judge the market, you won't be able to execute your system effectively.

FKLI

S1759.0 (20/06), C1733.0 (21/06)

L1738.5 (21/06), Open position

FCPO

S2468 (20/06), C2438 (21/06)

S2422 (21/06), Open position

Jun 20, 2013

Position Update 20130620

Invest time before money so that you have realistic expectations before trading with real money.

FKLI

S1759.0 (20/06), Open position

FCPO

L2471 (19/06), C2485 (20/06)

S2468 (20/06), Open position

FKLI

S1759.0 (20/06), Open position

FCPO

L2471 (19/06), C2485 (20/06)

S2468 (20/06), Open position

Jun 19, 2013

Position Update 20130619

You need a sound strategy, whether discretionary or systematic, in order to be profitable. Not everyone can create and implement such a strategy. This makes trading such a difficult business.

FKLI

S1764.5 (18/06), C1772.0 (19/06)

FCPO

L2471 (19/06), Open position

FKLI

S1764.5 (18/06), C1772.0 (19/06)

FCPO

L2471 (19/06), Open position

Jun 18, 2013

Position Update 20130618

Fewer rules increase strategy robustness, at the expenses of lower return and higher risks.

FKLI

L1765.0 (17/06), C1768.0 (18/06)

S1764.5 (18/06), Open position

FCPO

Nil

FKLI

L1765.0 (17/06), C1768.0 (18/06)

S1764.5 (18/06), Open position

FCPO

Nil

Jun 17, 2013

Position Update 20130617

It is the images you evoke like failure, unworthiness, and shame that wastefully use your creative imagination to bring further bad events into your life.

FKLI

L1765.0 (17/06), Open position

FCPO

Nil

FKLI

L1765.0 (17/06), Open position

FCPO

Nil

Jun 14, 2013

FCPO Performance Summary: 16 May - 14 June

Labels:

FCPO

,

Performance Summary

Position Update 20130416

We shape our trading by our words, thoughts and beliefs.

FKLI

S1760.5 (13/06), C1746.0 (14/06)

FCPO

L2438 (14/06), C2439 (14/06)

FKLI

S1760.5 (13/06), C1746.0 (14/06)

FCPO

L2438 (14/06), C2439 (14/06)

Jun 13, 2013

Position Update 20130613

When nothing is sure, anything is possible.

FKLI

S1760.5 (13/06), Open position

FCPO

L2454 (13/06), C2440 (13/06)

FKLI

S1760.5 (13/06), Open position

FCPO

L2454 (13/06), C2440 (13/06)

Jun 12, 2013

Position Update 20130612

It is easy to become a trader but not easy to be a profitable one.

FKLI

S1781.0 (11/06), C1770.0 (12/06)

FCPO

S2442 (11/06), C2460 (12/06)

FKLI

S1781.0 (11/06), C1770.0 (12/06)

FCPO

S2442 (11/06), C2460 (12/06)

Jun 11, 2013

Position Update 20130611

When market suppose to go up but didn't, it probably will drop.

FKLI

L1769.5 (07/06), C1781.0 (11/06)

S1781.0 (11/06), Open position

FCPO

S2442 (11/06), Open position

FKLI

L1769.5 (07/06), C1781.0 (11/06)

S1781.0 (11/06), Open position

FCPO

S2442 (11/06), Open position

Jun 10, 2013

Position Update 20130610

Just because a market had gone up significantly doesn't mean it will stop going up.

FKLI

L1769.5 (07/06), Open position

FCPO

L2459 (07/06), C2456 (10/06)

FKLI

L1769.5 (07/06), Open position

FCPO

L2459 (07/06), C2456 (10/06)

Jun 7, 2013

Position Update 20130607

Trading is not just about money. It is an adventure.

FKLI

S1769.5 (06/06), C1766.5 (07/06)

L1769.5 (07/06), Open position

FCPO

L2383 (05/06), C2445 (07/06)

L2459 (07/06), Open position

FKLI

S1769.5 (06/06), C1766.5 (07/06)

L1769.5 (07/06), Open position

FCPO

L2383 (05/06), C2445 (07/06)

L2459 (07/06), Open position

Jun 6, 2013

Position Update 20130606

Don't trade differently if you are winning or losing.

FKLI

L1772.0 (04/06), C1769.5 (06/06)

S1769.5 (06/06), Open position

FCPO

L2383 (05/06), Open position

FKLI

L1772.0 (04/06), C1769.5 (06/06)

S1769.5 (06/06), Open position

FCPO

L2383 (05/06), Open position

Jun 5, 2013

Position Update 20130605

Don't feel good if you are winning, so you won't feel bad if you are losing.

FKLI

L1772.0 (04/06), Open position

FCPO

S2371 (04/06), C2383 (05/06)

L2383 (05/06), Open position

FKLI

L1772.0 (04/06), Open position

FCPO

S2371 (04/06), C2383 (05/06)

L2383 (05/06), Open position

Jun 4, 2013

Position Update 20130604

When a trader is fighting the market, he is usually fighting his ego.

FKLI

L1772.0 (04/06), Open position

FCPO

S2390 (03/06), C2383 (04/06)

S2371 (04/06), Open position

FKLI

L1772.0 (04/06), Open position

FCPO

S2390 (03/06), C2383 (04/06)

S2371 (04/06), Open position

Jun 3, 2013

Position Update 20130603

When the goal posts keep moving, we have to move with the goal posts.

FKLI

S1765.0 (03/06), C1771.0 (03/06)

FCPO

L2393 (30/05), C2403 (03/06)

S2390 (03/06), Open position

FKLI

S1765.0 (03/06), C1771.0 (03/06)

FCPO

L2393 (30/05), C2403 (03/06)

S2390 (03/06), Open position

May 31, 2013

FKLI Performance Summary: May13 contract

A volatile month for Malaysia equity market. Fortunately, system managed to take advantage of market condition and make a profit. System did 12 trades, including pre-election a short, which turned out to be a big loser. Anyhow, 9/12 is the win lose ratio. Below are the results:-

Labels:

FKLI

,

Performance Summary

Position Update 20130531

No one cares about your profits and losses, they only care about theirs.

FKLI

Nil

FCPO

L2393 (30/05), Open position

FKLI

Nil

FCPO

L2393 (30/05), Open position

May 30, 2013

Position Update 20130530

Don't wait until it's perfect.

FKLI

L1780.5 (29/05), C1772.5 (30/05)

FCPO

L2411 (29/05), C2380 (30/05)

L2393 (30/05), Open position

FKLI

L1780.5 (29/05), C1772.5 (30/05)

FCPO

L2411 (29/05), C2380 (30/05)

L2393 (30/05), Open position

May 29, 2013

Position Update 20130529

Drawdown is inevitable. If you avoid drawdown, you are avoiding profits at the same time.

FKLI

L1769.5 (28/05), C1773.5 (29/05)

L1780.5 (29/05), Open position

FCPO

L2411 (29/05), Open position

May 28, 2013

Position Update 20130528

If you don't fully accept and love yourself as you are, you could be more prone to comparing yourself to others as a way of artificially boosting your feeling of self-worth.

FKLI

S1761.5 (23/05), C1769.5 (28/05)

L1769.5 (28/05), Open position

FCPO

L2383 (27/05), C2375 (28/05)

S2375 (28/05), C2399 (28/05)

FKLI

S1761.5 (23/05), C1769.5 (28/05)

L1769.5 (28/05), Open position

FCPO

L2383 (27/05), C2375 (28/05)

S2375 (28/05), C2399 (28/05)

May 27, 2013

Position Update 20130527

The diabolical purpose of the market is to continue higher (or lower), with as few people on board as possible.

FKLI

S1761.5 (23/05), Open position

FCPO

L2383 (27/05), Open position

FKLI

S1761.5 (23/05), Open position

FCPO

L2383 (27/05), Open position

May 23, 2013

Position Update 20130523

FKLI

S1778.0 (22/05), C1771.5 (23/05)

S1761.5 (23/05), Open position

FCPO

L2369 (23/05), C2350 (23/05)

May 22, 2013

Position Update 20130522

FKLI

L1780.0 (21/05), C1786.0 (22/05)

S1778.0 (22/05), Open position

FCPO

L2340 (21/05), C2352 (22/05)

Position Update 20130521

The best market guru is the market itself.

FKLI

L1780.0 (21/05), Open position

FCPO

L2342 (20/05), C2329 (21/05)

L2340 (21/05), Open position

FKLI

L1780.0 (21/05), Open position

FCPO

L2342 (20/05), C2329 (21/05)

L2340 (21/05), Open position

May 20, 2013

Position Update 20130520 + Account Statement

Received an email asking whether system trades real money or just "demo account". To prove that real money is involved, I will show part of the trading account statement in this posting.

<img src="statement.jpg" width="846" height="185"></body>

</html>

FKLI

Nil

FCPO

L2342 (20/05), Open position

<img src="statement.jpg" width="846" height="185"></body>

</html>

FKLI

Nil

FCPO

L2342 (20/05), Open position

Labels:

Account Statement

,

Comments

,

FCPO

,

FKLI

May 17, 2013

Position Update 20130517

Never lose sight of your portfolio total risk exposure.

FKLI

S1772.5 (16/05), C1766.0 (17/05)

FCPO

L2309 (16/05), C2330 (17/05)

FKLI

S1772.5 (16/05), C1766.0 (17/05)

FCPO

L2309 (16/05), C2330 (17/05)

May 16, 2013

Position Update 20130516

The fewer parts it has, the less likely it is to break down.

FKLI

S1789.5 (15/05), C1782.0 (16/05)

S1772.5 (16/05), Open position

FCPO

L2309 (16/05), Open position

May 15, 2013

Position Update 20130515

Successful traders accept diverse possibilities, disorder, randomness, and chaos. They develop strategies to deal with such uncertainties.

FKLI

S1789.5 (15/05), Open position

FCPO

S2310 (13/05), C2286 (15/05)

FKLI

S1789.5 (15/05), Open position

FCPO

S2310 (13/05), C2286 (15/05)

May 14, 2013

Position Update 20130514

The problem with liquidity is that it is never there when really needed.

FKLI

L1776.0 (13/05), C1782.0 (14/05)

FCPO

S2310 (13/05), Open position

FKLI

L1776.0 (13/05), C1782.0 (14/05)

FCPO

S2310 (13/05), Open position

May 13, 2013

Position Update 20130513

If you want to make easy money, don't be a trader. Trading is one of the toughest ways to make easy money.

FKLI

S1769.5 (08/05), C1768.5 (13/05)

L1776.0 (13/05), Open position

FCPO

L2310 (10/05), C2330 (13/05)

S2310 (13/05), Open position

FKLI

S1769.5 (08/05), C1768.5 (13/05)

L1776.0 (13/05), Open position

FCPO

L2310 (10/05), C2330 (13/05)

S2310 (13/05), Open position

May 10, 2013

Position Update 20130510

无法得到民心的领袖,迟早会被换掉。

FKLI

S1769.5 (08/05), Open position

FCPO

L2290 (08/05), C2297 (10/05)

L2310 (10/05), Open position

FKLI

S1769.5 (08/05), Open position

FCPO

L2290 (08/05), C2297 (10/05)

L2310 (10/05), Open position

May 9, 2013

Position Update 20130509

It is a man's own mind, not his enemy or foe, that lures him to evil ways.

FKLI

S1769.5 (08/05), Open position

FCPO

L2290 (08/05), Open position

FKLI

S1769.5 (08/05), Open position

FCPO

L2290 (08/05), Open position

May 8, 2013

Position Update 20130508

It wasn’t possible to make money without the threat of losing it.

FKLI

S1769.5 (08/05), Open position

FCPO

L2268 (07/05), C2271 (08/05)

L2290 (08/05), Open position

FKLI

S1769.5 (08/05), Open position

FCPO

L2268 (07/05), C2271 (08/05)

L2290 (08/05), Open position

Crude Oil Futures

CME Crude Oil Futures (CL), also known as West Texas Intermediate (WTI) is one of the most active and liquid market in the futures market. WTI is the benchmark for Crude Oil pricing. In Malaysia, it didn't enjoy the same popularity as compare to our beloved FKLI and FCPO. It is probably due to its long trading hours and volatility. It trades almost 24 hours a day. However, I strongly recommend this market to readers because of its volatility, liquidity and profit opportunity.

Click here to know about Crude Oil Futures Contract Specs.

As usual I will share with you system performance in this market for the past 2 months.

Click here to know about Crude Oil Futures Contract Specs.

As usual I will share with you system performance in this market for the past 2 months.

Labels:

Futures Products

,

Performance Summary

May 7, 2013

Position Update 20130507

I would rather lose than cheat.

FKLI

Nil

FCPO

S2262 (03/05), C2249 (07/05)

L2268 (07/05), Open position

FKLI

Nil

FCPO

S2262 (03/05), C2249 (07/05)

L2268 (07/05), Open position

May 6, 2013

Position Update 20130506

I know you are going through hell like I do, but keep on going. NEVER NEVER NEVER GIVE UP. When you feel like giving up, remember why you held on for so long in the first place.

FKLI

S1694.0 (03/05), C1730.0 (06/05)

L1740.0 (06/05), C1798.0 (06/05)

FCPO

S2262 (03/05), Open position

May 5, 2013

May 3, 2013

Position Update 20130503

Disregard for the past will never do us any good. Without it we cannot know truly who we are.

FKLI

S1703.0 (02/05), C1701.5 (03/05)

S1694.0 (03/05), Open position

FCPO

L2280 (03/05), C2262 (03/05)

S2262 (03/05), Open position

We are heading into the polls on Sunday. We are expecting volatile movement when market reopen on Monday. Attached FKLI and FCPO daily chart during 2008 GE12 for your reference.

FKLI

S1703.0 (02/05), C1701.5 (03/05)

S1694.0 (03/05), Open position

FCPO

L2280 (03/05), C2262 (03/05)

S2262 (03/05), Open position

We are heading into the polls on Sunday. We are expecting volatile movement when market reopen on Monday. Attached FKLI and FCPO daily chart during 2008 GE12 for your reference.

Labels:

Case Study

,

FCPO

,

FKLI

,

Quote

May 2, 2013

Position Update 20130502

Successful traders face the same frustrations, hurdles, and fears as everyone else. The difference is in the way they handle their fear. Rather than feeling defeated or immobilized by their fears and worries, they conquer them.

FKLI

S1703.0 (02/05), Open position

FCPO

Nil

FKLI

S1703.0 (02/05), Open position

FCPO

Nil

May 1, 2013

Order Types and How to Use Them

I am writing this post to explain few types of orders we normally

use in trading.

Market - This is the most

basic and frequently used order type which tells the exchange's computers

to execute your order at the next available price. If you are buying your

fill price will be the next available offer and if you are selling your

fill will be the next available bid. To get a better indication of

where you might be filled you need to look at the current bid/offer. For

example, above is the bids/offers for Crude Oil June13. If you Buy Market 1

lot, you will get fill @ 92.98. If you Buy Market 10 lots, you will get 1 lot @

92.98 and the remaining 9 lots @ 92.99. The difference between bid and offer is

known as spread. In a liquid market like Crude Oil futures, the spread is

small, in this case, 1 tick. The

advantage of using market order is that you will certainly get your fill in the

fastest possible time. However the pitfall is that in a fast moving market,

when liquidity is low, you might get very big slippage.

Limit - This is an order

to buy or sell at a designated price. Normally we place a limit to buy is below

the current market price, while a limit to sell is placed above the current

market price. For example, you place a Buy Limit Order for Crude Oil

futures 10 lots @ 92.00 when market is trading higher (92.97 vs 92.98). All

orders are filled on a First In First Out basis (FIFO); your order will be

placed in the queue on the exchange’s computers. Your order will only be filled after

those orders in front of yours are executed.

Stop - Stop order are

used as stoploss as well as entry for some traders. A Buy Stop Order is

placed above the current market price and Sell Stop is placed below the current

market price. Stop Order is a price order turn into Market Orders once the designated

price trades. For example, we place a Buy Stop Order 10 lots Crude Oil futures

@ 94.00, when market is currently trading @ 92.89 vs 92.90. When market trades

@ 94.00, our Buy Stop 10 lots @ 94.00 will become Buy Market 10 lots. This

means when market trades @ 94.00, we will buy 10 lots Crude Oil at next

available offer price. Once triggered, our order will compete with other

incoming Buy Market Orders; therefore doesn't guarantee our fill price same as

the Buy Stop Price. The difference

between Stop Price and Fill Price is slippage.

Order Cancels Order (OCO) - An OCO is actually

two separate orders that are placed around a position, one of the orders is

your Limit order to take a profit and the other is your Stop order to get out at

a loss. The advantage of this order is that once the profit or loss

order is hit, the trading platform will cancel the remaining order for you. For

example, you buy FCPO @ 2280 and place your Stoploss, a Sell Stop Order @

2269 and Profit Target, a Sell Limit @ 2300. Once market trades either 2269 or

2300, the other order is automatically cancelled. However, I don’t think Bursa

Malaysia Derivative or futures brokers in Malaysia offer this order

in their services.

Trailing Stop - A trailing stop allows you to enter a Stop loss

order and have it move as the market moves in your favor based on your

preset parameters. This allows you to lock in a potential profit

if the market moves in your favor. Let say you short FCPO @ 2280,

with stoploss @ 2300 and no profit target. When market moves lower to 2250, you

can have your stop moved lower down to 2265. You may continue to lower your

stops if market moves lower, ultimately when market reverse and take out your

stops, you are out with reasonable profits. But don’t forget stops order doesn't guarantee you exit at your designated stop price. There might be slippage.

There are numerous more advance orders that are

available in the marketplace but I don’t think they are available in our

markets yet. So, I won’t cover here. Now, you know the type of orders. Try to

incorporate these orders in your trading strategy and hopefully it helps you in

your trading.

Labels:

Strategy

Apr 30, 2013

Position Update 20130430

It is helpful to have buy stops or sell stops resting in the market which will automatically take you into the trade, but then you must manage the trade in terms of how the market responds.

FKLI

L1714.5 (30/04), C1716.0 (30/04)

FCPO

S2311 (29/04), C2288 (30/04)

FKLI

L1714.5 (30/04), C1716.0 (30/04)

FCPO

S2311 (29/04), C2288 (30/04)

Apr 29, 2013

Position Update 20130429

You can’t expect your knowledge of yesterday to carry you through tomorrow.

FKLI

L1710.0 (25/04), C1711.5 (29/04)

FCPO